Image source: https://www.cbo.gov/sites/default/files/114th-congress-2015-2016/reports/50923-marginaltaxrates.pdf

Image source: https://www.cbo.gov/sites/default/files/114th-congress-2015-2016/reports/50923-marginaltaxrates.pdf

America’s government gives benefits to the poor: food, health insurance, and (sometimes) housing. When the poor earn more, those benefits go away while they also pay more in taxes. Unfortunately, the benefits and taxes were not designed with each other in mind. There are times when the poor lose more than $800 to taxes and lost benefits for every $1000 more they earn.

There’s a whole alphabet soup of benefits for the poor: SNAP, Section 8, TANF, EITC, and Medicaid. (And many poor also qualify for WIC and SSI!) I’ll keep it simple and just look at SNAP and Section 8 in detail.

SNAP’s long name is the “Supplemental Nutrition Assistance Program”, but it is better known by its old name, “Food Stamps”. It helps the poor pay for food. A family of two (mother and child) can receive up to $4,236 yearly in benefits.

The government tries get people off the dole slowly. So, for every $1,000 the family earns, the benefit drops by $300. That acts very similar to a tax — if the family earns $1000 more, because of the lost benefit, they only grow $700 richer.

Now consider another benefit, Section 8 (a.k.a. “Housing Choice Voucher Program”). It helps the poor pay for housing. They need help, because housing is expensive — 1 in 6 households pay more than 50% of their income on housing. If you’re lucky enough to get a Section 8 voucher (and only a few do), it limits the cost of your rent to 30% of your income.

So, if a family’s income increases by $1000, the family will have to pay $300 more in rent. That sounds fair … until you realize that the family probably also has SNAP. So, the family has earned an extra $1000, but the rent grew by $300 and they lost $300 in SNAP benefits, so they only grow $400 richer. That’s an effective marginal tax rate of 60%.

The other benefits behave similarly. So, the “tax” from lost benefits adds up.

But let’s not forget that the poor also pay actual tax. The payroll tax is 9.3% and it is paid on every dollar you earn, even if you live in poverty. The tax pays for Social Security and Medicare. The effective marginal tax rate is now 69.3%. Earn an extra $1000 and take home a little more than $300.

The politicians say “the employer pays half of the Social Security tax”, but that’s a lie — economists will tell you that money still comes out of the money the employee would have taken home. So, your actual salary is 6.4% larger than you think it is and the payroll tax is actually 14.4% of every dollar. After adjusting to this reality, the effective marginal tax rate is now 70.8%. Earn an extra $1000 and take home less than $300.

And that’s just the tip of the iceberg: 2 benefits and the payroll tax. There are still 3 more benefits and federal income tax. And let’s not forget state income tax and sales tax! So a 70.8% effective marginal tax rate is not even the maximum.

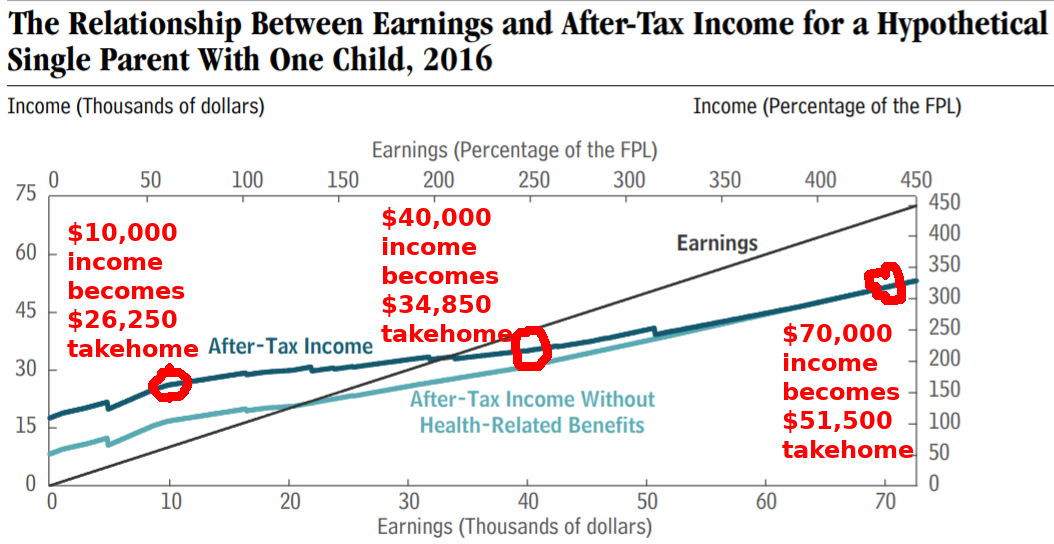

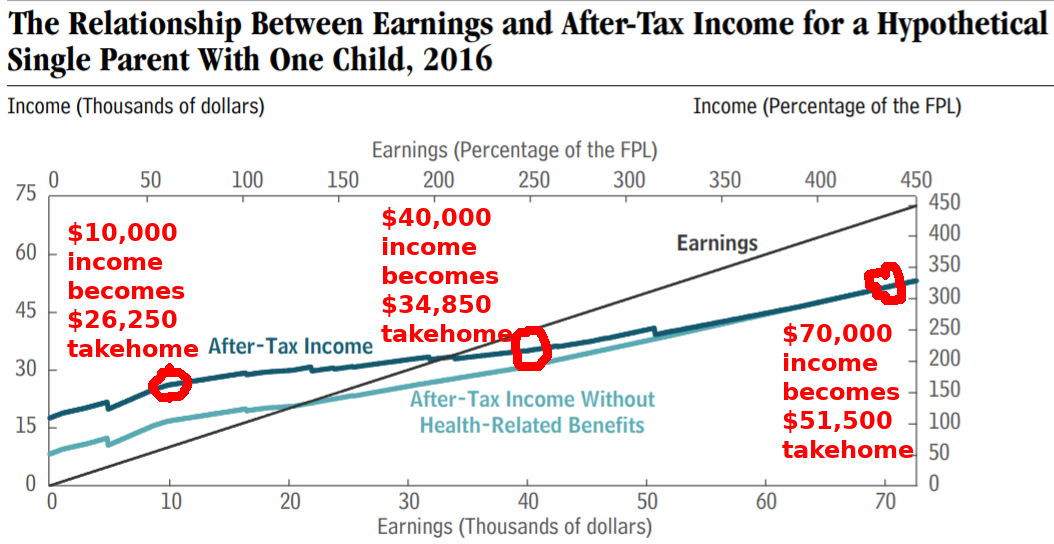

The Congressional Budget Office looked at the case of a single mother with one child, living in Pennsylvania. The study accounted all the benefits and taxes, except state sales tax and Section 8 housing. If the mother went from earning $10,000 to earning $40,000, after accounting for taxes and lost benefits, her family would be only $8,600 richer. On that $30,000 of additional income, they would be paying an effective marginal tax rate over 70%.

Image source: https://www.cbo.gov/sites/default/files/114th-congress-2015-2016/reports/50923-marginaltaxrates.pdf

Image source: https://www.cbo.gov/sites/default/files/114th-congress-2015-2016/reports/50923-marginaltaxrates.pdf

If the family earned $30,000 more — went from $40,000 to $70,000 — they would pay an effective marginal tax rate of only 44%.

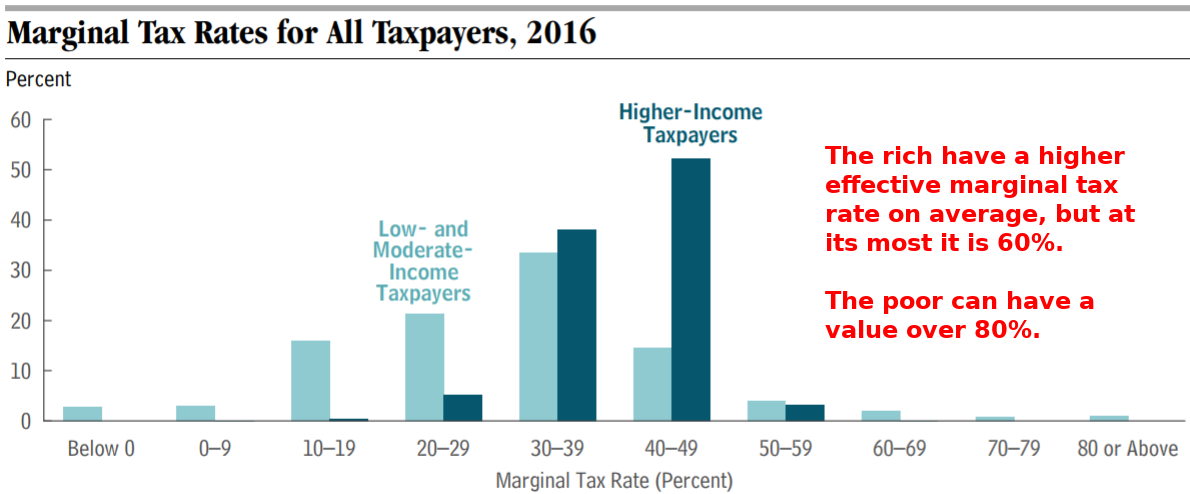

That’s right: the rich can pay a lower effective marginal tax than the poor. To see how common this was, the CBO did a simulation based on household size and income levels.

Image source: https://www.cbo.gov/sites/default/files/114th-congress-2015-2016/reports/50923-marginaltaxrates.pdf

Image source: https://www.cbo.gov/sites/default/files/114th-congress-2015-2016/reports/50923-marginaltaxrates.pdf

Less than 4% of the rich pay an effective marginal tax rate greater than 50% and none pay more than 60%. While the poor sometimes see very low effective marginal tax rates, more than 8% of them see a rate above 50% and some above 80%. And this study ignored sales tax and Section 8 housing.

The problem is that the many programs benefiting the poor are not designed to work together. Nor work with the tax system. Each has a different definitions of “income”, so each requires its own paperwork. Each has different cutoff points (130%, 138%, or 200% of Federal Poverty Level or 80% of median local salary or just random dollar values) and a different definition of “need”, so applicants may qualify for some and not others. Each is run by a different government department. It is a mess.

And it is a tragedy. A marginal effective tax rate over 80% is way too high. Some poor people have almost no incentive to work. Or, at least, no incentive to work inside the system. They can always work on the black market outside the law, with its risks and without the record that might help them get a better job in the future. We should find a way to reach the American Dream inside the system. We need to fix this.